To decide which candidate to vote for, we have to determine the criteria we use for evaluating candidates. From how candidates campaign and how the media reports on these campaigns, we are led to believe that we are choosing our representative of ideal human. This is a faulty premise.

Voting for a political candidate is expressing a preference for that candidate to fill a position. The candidate is applying to fill a job opening, and we are evaluating candidates to hire the one most qualified. We should apply criteria that are relevant and appropriate for this evaluation, and refrain from misapplying criteria that are irrelevant or inappropriate. Is it appropriate to hire or disqualify a candidate based on gender, religion, race, or sexual preference? Of course not.

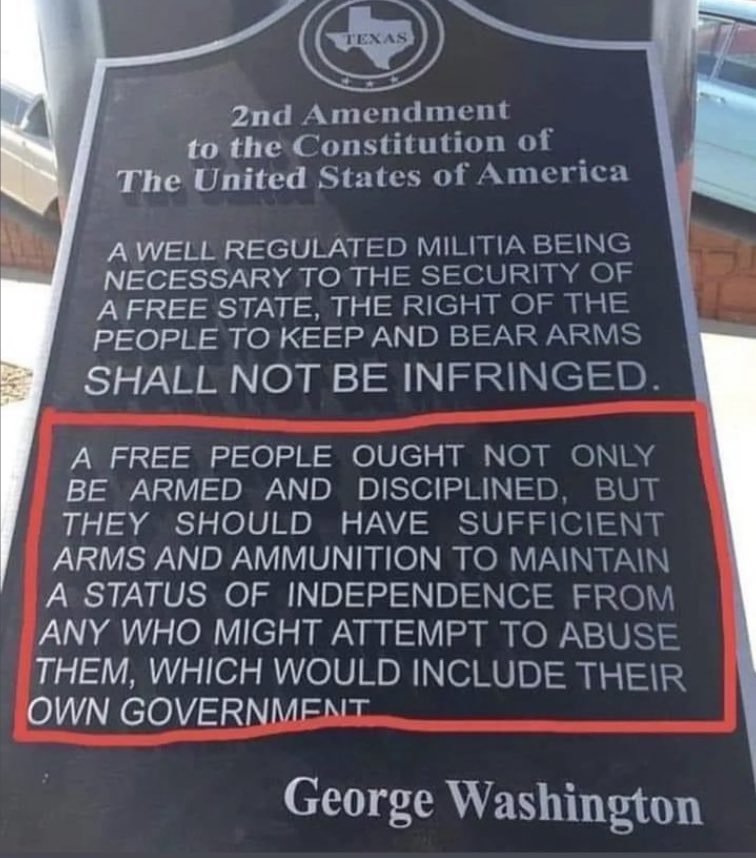

The US Constitution defines precisely the role of the federal government and its elected officials. Defending the Constitution entails the recognition of the limited authority that is granted to the federal government, while liberty is protected by recognizing the rights of the individual. The powers that sovereign individuals grant to the federal government are enumerated, while the rights of the individual are unlimited. Therefore, the proper way to evaluate a political candidate is to consider first and foremost how faithfully they understand and defend the Constitution. Then, evaluate how qualified that candidate is capable of performing the limited responsibilities of that office, while never overstepping the authority granted to the office by the Constitution.

When a Presidential candidate talks about how to be a responsible civilian leader of the military in the role of Commander-in-Chief, that candidate is expressing qualifications.

If a Presidential candidate talks about faithfully enforcing the laws passed by Congress, when those laws are pursuant to the Constitution, that candidate is expressing qualifications.

When a candidate talks about expanding public education and green energy initiatives, that candidate is disqualified.

If a candidate talks about increasing healthcare and retirement benefits through a government-run Ponzi scheme, that candidate is disqualified.

When a candidate talks about using taxpayer funds or debt to stimulate the economy or to improve your community, your family, or your life, that candidate is disqualified. Bribery is corrupt, and doing so during a job interview should be astonishing. Not only is the candidate disqualified, the candidate should be charged with criminal behavior.

If a candidate talks about being a likable, generous, and charitable member of the community, that candidate is lobbying for the job of celebrity but offering no substantial qualifications for the office.

We should not be seeking an admirable model citizen, who exemplifies our moral principles and projects our image of an ideal American. Doing so betrays our obligation to defend the Constitution. A candidate who asks for our trust in all things is asking for license to act with unlimited power. We don’t need someone who demands that degree of trust. A personality and appearance that we find likable is also unnecessary. We only need someone to perform a very limited job function for a fixed term.

The Constitution tells us exactly how we must vote. Now, if only voters would recognize that fact, they would then be equipped to fulfill their own pledge of allegiance, which implies a commitment to defend the Constitution.